It all started with Bitcoin

Creation and Purpose: Bitcoin was created as the first modern cryptocurrency to function as a universal currency, potentially replacing or complementing traditional fiat currencies. It was designed to enable easy transactions, akin to using a credit card, but leveraging advancements in computer and network technology to offer a decentralized and less regulated alternative to government-issued money.

Initial Vision vs. Reality: The vision for Bitcoin was for it to be used in everyday transactions, like buying a cup of coffee. However, over time, the platforms that allowed people to buy Bitcoin also facilitated the buying and selling of Bitcoin for fiat currencies. This led to Bitcoin being used more as an investment vehicle, with people buying it in hopes that its value would increase, and then selling it for a profit.

Investment Role: Besides its intended use as a digital currency, Bitcoin has become popular as an investment. People invest in Bitcoin, anticipating its value to rise, thus treating it as a digital asset rather than merely a medium of exchange.

Table of Contents

What are Cryptocurrencies?

Cryptocurrencies are decentralized virtual currencies that facilitate digital transactions without the necessity of intermediaries like banks. Key information, including the sender, receiver, and transaction amount, is encrypted and securely stored in a Blockchain, ensuring high levels of anonymity and transparency. There is a diverse array of cryptocurrencies available, such as Bitcoin, Ether, Litecoin, Tether, and Bitcoin Cash, each built on distinct protocols and tailored for various applications. Among these, Bitcoin, Ether, and Tether boast the highest market capitalization. Despite their prominence, determining the optimal cryptocurrency for investment, particularly one that yields the highest returns, remains challenging due to market volatility and evolving dynamics.

Main Cryptocurrencies And Their Features

| Cryptocurrency | Main Features | Functions |

|---|---|---|

| Bitcoin (BTC) | First and most well-known cryptocurrency; decentralized network using blockchain technology. | Digital currency for peer-to-peer transactions and a store of value. |

| Ether (ETH) | Native cryptocurrency of the Ethereum platform; supports smart contracts and decentralized applications (DApps). | Pays for transactions and computational services on the Ethereum network. |

| Litecoin (LTC) | Faster block generation times and different hashing algorithm (Scrypt); lighter version of Bitcoin. | Quicker and cheaper peer-to-peer transactions, suitable for smaller transactions. |

| Tether (USDT) | Stablecoin pegged to fiat currency (typically US Dollar). | Provides stability in the volatile cryptocurrency market, storing value without fluctuations. |

| Bitcoin Cash (BCH) | Fork of Bitcoin to improve transaction speeds and reduce fees by increasing the block size limit. | Practical currency for everyday transactions with lower fees and faster confirmation times. |

| Ripple (XRP) | Enables real-time, cross-border payment systems for banks and financial institutions. | Bridge currency for international transactions, reducing time and cost. |

| Cardano (ADA) | Emphasizes security, scalability, and sustainability; uses a proof-of-stake consensus mechanism called Ouroboros. | Powers the Cardano network, enabling secure and scalable smart contracts and DApps. |

| Polkadot (DOT) | Multi-chain network enabling different blockchains to interoperate; uses Nominated Proof-of-Stake (NPoS) consensus mechanism. | Used for governance, staking, and bonding in the Polkadot network, facilitating interoperability and scalability. |

| Chainlink (LINK) | Decentralized oracle network providing real-world data to smart contracts. | Pays for data feeds and services within the Chainlink ecosystem, enabling interaction with external data sources. |

| Stellar (XLM) | Facilitates fast, low-cost cross-border transactions; connects financial institutions and unbanked populations. | Pays for transaction fees and maintains network integrity on the Stellar network. |

| Binance Coin (BNB) | Native cryptocurrency of the Binance exchange; migrated to Binance’s own blockchain, Binance Chain. | Pays for transaction fees on Binance exchange, participates in token sales, and powers Binance Smart Chain. |

How do Cryptocurrencies work?

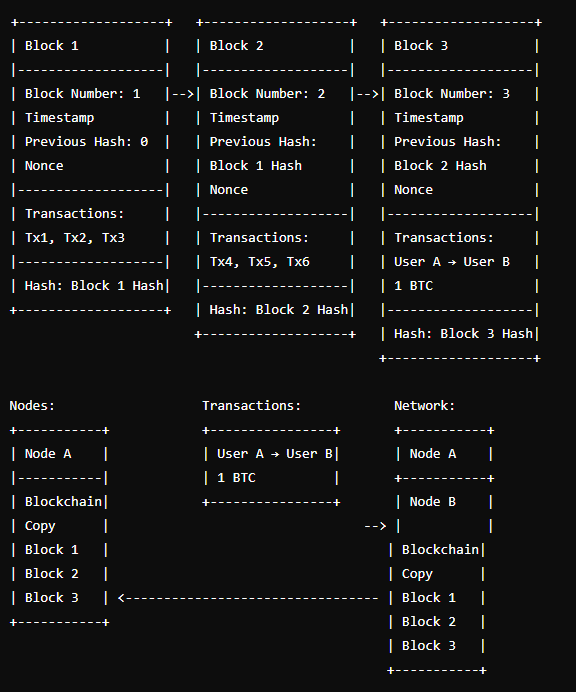

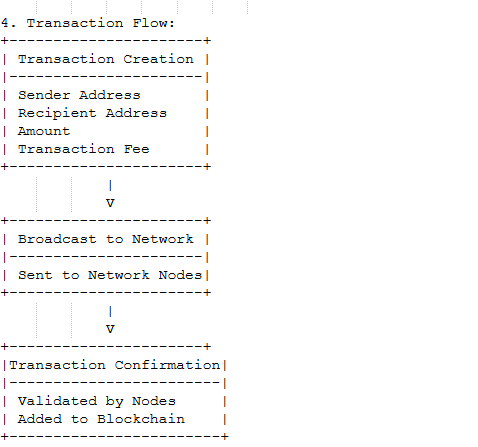

Blockchain serves as a digital ledger for most cryptocurrencies, playing a critical role in ensuring the security and integrity of digital transactions. It is a chronological sequence of data and information, visualized as a chain of consecutive data blocks that can grow indefinitely. With each new transaction, a new block is added to the chain, making the system transparent and tamper-proof.

Blockchain Visualization example:

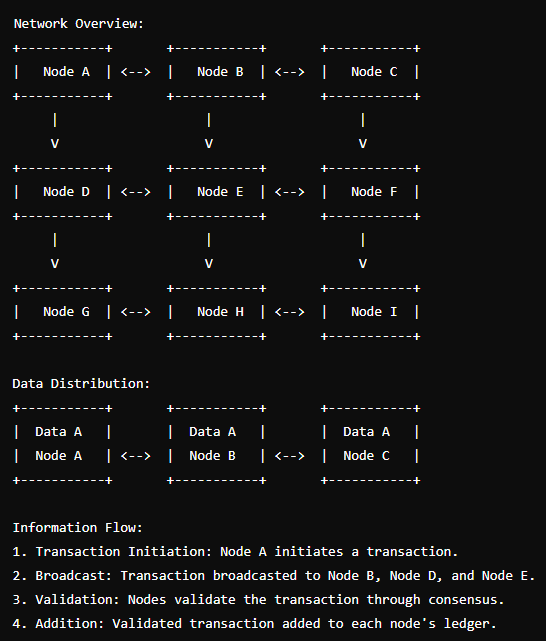

Data storage in this system is decentralized, spread across a broad network of computers known as nodes. This decentralization is fundamental to the blockchain’s security, as it eliminates a single point of failure. Anyone can join this network and contribute computing power to maintain the ledger, making it resilient to attacks and failures.

Decentralized Network Diagram example:

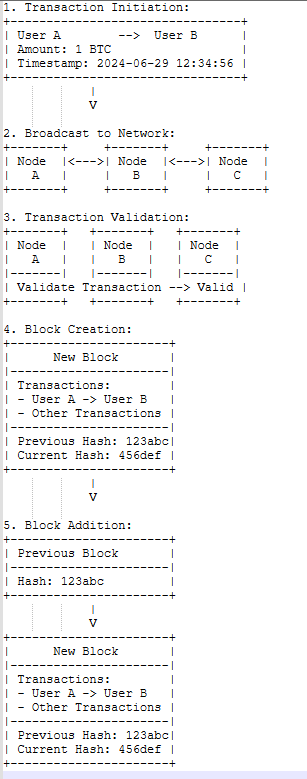

Transaction Verification Process example:

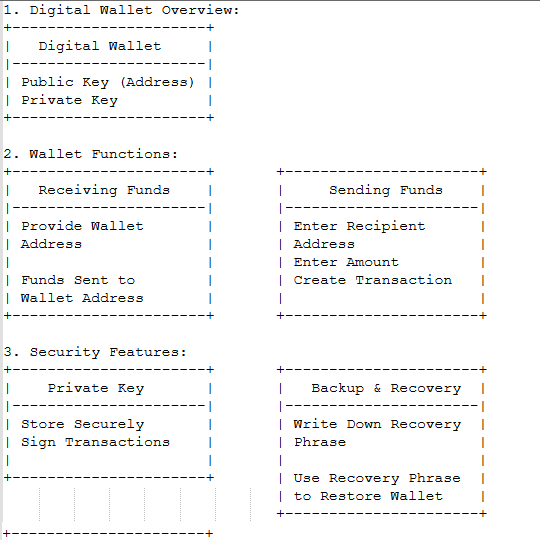

Transaction verification is achieved through a unique code called a hash value, calculated using a hash function. This function compresses large data amounts into a smaller encrypted string, making the transaction traceable and verifiable. Each block contains the hash values of all previous transactions, ensuring chronological order and preventing manipulation. This robust verification process not only secures transactions but also builds trust among users by ensuring data integrity.

Transaction Verification Process example:

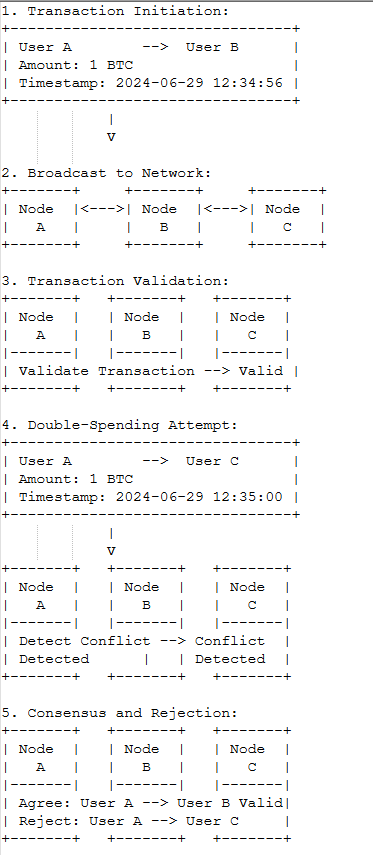

This structure also effectively prevents double-spending, as each block’s inclusion of previous hash values makes it nearly impossible to alter past transactions. Double-spending, a common issue in digital currency, is thus mitigated, ensuring that the same coin cannot be used more than once.

Prevention of Double-Spending example:

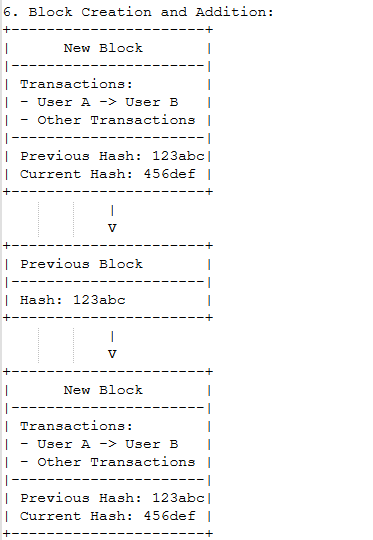

Cryptocurrencies, not being physically available and unable to be stored in traditional bank accounts, are kept in digital wallets. These wallets store the coins and tokens of various cryptocurrencies, ensuring secure and accessible management of digital assets. Digital wallets come in different forms, including software wallets, which are applications installed on a computer or smartphone, and hardware wallets, which are physical devices that store cryptocurrencies offline, providing an additional layer of security against hacking.

Digital Wallet Usage example:

Furthermore, the adoption of blockchain technology extends beyond cryptocurrencies. Industries such as supply chain management, healthcare, and finance are exploring blockchain for its potential to improve transparency, traceability, and efficiency. By leveraging blockchain, these sectors aim to enhance data security, streamline operations, and reduce costs.

In conclusion, the blockchain not only underpins the functionality and security of cryptocurrencies but also represents a transformative technology with broad applications across various industries. Its decentralized nature, robust transaction verification, and prevention of double-spending make it a cornerstone of modern digital innovation.

The Difference between Coins and Tokens

Coins are digital assets that operate on their own independent blockchain. Examples include Bitcoin (BTC), Ethereum (ETH), and Monero (XMR). Coins are primarily used as a medium of exchange and share characteristics with traditional forms of value exchange: they are fungible, divisible, portable, and limited in supply. Some coins, like Ether, also facilitate transactions within their blockchain.

Tokens, on the other hand, are digital assets that operate on an existing blockchain network, such as Ethereum. They don’t have their own blockchain and often serve a broader range of functions within a specific project’s ecosystem. Tokens can be used for payments but are typically designed to enable access to certain features of a project. An example is the Basic Attention Token (BAT), used to improve digital advertising.

The technical differences between coins and tokens are significant. Coins run on their own blockchain, while tokens rely on an existing blockchain platform. Creating a coin requires building a new blockchain, which is time-consuming and requires specialized knowledge. In contrast, tokens can be created on existing blockchains, making the process simpler and more accessible.

The use cases of coins and tokens also differ. Coins are mainly used as a medium of exchange similar to digital cash and can be used to pay for transactions within their network. Tokens, however, are designed to serve a variety of purposes beyond just payments. They often provide access to features of a specific project or protocol within the blockchain ecosystem.

Examples of coins include Bitcoin, Ethereum, and Monero, while examples of tokens include ERC-20 tokens on Ethereum, such as BAT, which is used in digital advertising.

In the crypto ecosystem, coins form the foundation of secure and decentralized networks, while tokens facilitate the development of decentralized applications (DApps) and other blockchain-based platforms, contributing to the diversity and flexibility of the cryptocurrency space.

The Evolution and Challenges of Cryptocurrency Mining

Mining is the process of generating cryptocurrencies by providing computational power to validate crypto transactions. Miners are rewarded with cryptocurrencies for their contributions. In the early days of cryptocurrencies, individual mining from home was feasible and relatively straightforward. Private individuals could mine cryptocurrencies like Bitcoin and Ether using a home PC or laptop equipped with appropriate software and a wallet.

However, the landscape of mining has drastically changed due to current challenges. The number of miners has significantly increased, leading to higher competition. Additionally, due to the high number of miners and rising energy costs, private mining has become economically unfeasible. Mining requires substantial electricity to power the necessary computational resources, making it costly.

Effective mining now demands high computational power. Miners with the latest and fastest technology have a competitive edge, while older or less powerful machines are at a disadvantage. This technological requirement has further marginalized private individuals from the mining process.

The rapid increase in the value of Bitcoin has led to the establishment of professional mining operations. These operations often involve large facilities filled with high-performance computers dedicated to mining cryptocurrencies 24/7. As a result, mining has shifted from being a viable activity for private individuals to being dominated by large-scale professional setups.

Cryptocurrency Investments: Acquisition, Trading, and Risk Management with Raisin Crypto

Acquisition Methods:

Buying on cryptocurrency exchanges is a common way to acquire cryptocurrencies like Bitcoin and Ether using traditional currencies such as EUR or USD. Another method is mining, particularly associated with Bitcoin, where validating Bitcoin transactions and adding them to the blockchain rewards miners with Bitcoin.

Trading and Investment:

For major cryptocurrencies, direct purchase with fiat currencies is possible. For smaller cryptocurrencies, purchasing often requires an intermediate step of buying a larger cryptocurrency like Bitcoin first. Notably, it is not necessary to buy an entire Bitcoin; partial coins can be purchased down to eight decimal places. Raisin Crypto offers a way to invest in multiple cryptocurrencies simultaneously through ETNs (Exchange-Traded Notes), avoiding the need for unregulated crypto exchanges. ETNs allow for risk diversification, and quarterly rebalancing helps maintain the original weighting of the investment portfolio. Raisin Crypto also offers the option to set up a cryptocurrency savings plan (Krypto-Sparplan).

Risk Management:

Due to their high volatility, cryptocurrencies should be viewed as an additional component to a diversified portfolio, which may already include stocks, bonds, and savings accounts. Investing in a range of cryptocurrencies can help mitigate risks.

Platform Benefits:

Raisin’s platform allows for the centralized management of various investment types, combining them with preferred cryptocurrencies. The platform is designed for ease of use, requiring a simple registration and a one-time verification process.

Crypto Market Dynamics

The crypto market dynamics are characterized by rapid fluctuations and high volatility, influenced by various factors such as technological advancements, regulatory developments, market sentiment, and macroeconomic trends. Unlike traditional markets, the cryptocurrency market operates 24/7, leading to continuous price changes and trading opportunities. The introduction of new technologies and platforms, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), further drives market innovation and investor interest. Regulatory news, whether positive or negative, can significantly impact market confidence and pricing. Additionally, macroeconomic factors like inflation rates and currency devaluations can lead to increased adoption and valuation of cryptocurrencies as alternative assets. Understanding these dynamics is crucial for investors aiming to navigate the complexities of the crypto market and leverage its potential for high returns.

Crypto Investment Strategies Overview

| Investment Strategy | Description | Objective | Advantages | Risks |

|---|---|---|---|---|

| Buy and Hold (HODL) | Purchasing cryptocurrencies and holding them for a long period. | To benefit from long-term price appreciation. | Simple to execute, no need for constant monitoring. | Vulnerable to prolonged market downturns. |

| Dollar-Cost Averaging (DCA) | Investing a fixed amount of money at regular intervals. | To reduce the impact of volatility and avoid trying to time the market. | Mitigates the risk of investing a large sum at the wrong time. | May not capture the lowest price points, resulting in higher average costs during uptrends. |

| Swing Trading | Buying and selling cryptocurrencies based on short- to medium-term price movements. | To profit from price swings within a trend. | Potential for higher returns through active management. | Requires significant time, market knowledge, and technical analysis skills. |

| Day Trading | Buying and selling cryptocurrencies within the same day. | To profit from intraday price volatility. | High potential returns through frequent trading. | Highly time-intensive, requires deep market knowledge and technical analysis skills, incurs higher transaction fees. |

| Staking | Locking up a certain amount of cryptocurrency to support the operations of a blockchain network. | To earn staking rewards (interest) in the form of additional tokens. | Generates passive income, supports network security. | Price volatility of the staked cryptocurrency, lock-up periods may limit liquidity. |

| Yield Farming | Providing liquidity to DeFi platforms in exchange for interest or additional tokens. | To maximize returns through high-interest rates offered by DeFi protocols. | High potential returns, multiple earning opportunities. | Smart contract vulnerabilities, impermanent loss, high volatility of DeFi tokens. |

| Portfolio Diversification | Investing in a mix of different cryptocurrencies and assets to spread risk. | To reduce risk by not putting all investments into a single asset. | Mitigates the impact of poor performance by any single asset. | Diversification can dilute potential returns if too spread out or if the portfolio is not well-balanced. |

| Investing in ICOs and Token Sales | Participating in early-stage fundraising rounds for new blockchain projects. | To gain early access to potentially high-growth projects at a lower price. | Potential for significant returns if the project succeeds. | High risk of fraud, regulatory uncertainties, and project failure. |

| Risk Management and Hedging | Using strategies such as stop-loss orders, options, or futures to mitigate potential losses. | To protect the portfolio from significant downturns. | Reduces potential losses, helps maintain portfolio value during market volatility. | Can limit potential upside, complex strategies may require advanced knowledge. |

| Participating in Crypto Savings Accounts | Depositing cryptocurrencies in interest-bearing accounts offered by various platforms. | To earn interest on idle crypto assets. | Generates passive income with minimal effort. | Platform risk, lower returns compared to other high-risk strategies, regulatory uncertainties. |

Legal and Tax Implications

Legal and Tax Implications of cryptocurrency investments are critical considerations for investors. The regulatory environment for cryptocurrencies varies widely by country, influencing how digital assets are classified, traded, and taxed. In many jurisdictions, cryptocurrencies are considered taxable property rather than currency, which means that transactions such as selling, exchanging, or spending crypto can trigger capital gains taxes. Additionally, some countries have specific reporting requirements for cryptocurrency holdings, requiring investors to disclose their digital assets and transactions to tax authorities. Failure to comply with these regulations can result in significant penalties. Moreover, regulatory bodies are continuously evolving their approaches to cryptocurrency, which can lead to changes in legal status and tax obligations. Investors should stay informed about the legal and tax frameworks in their respective countries and consider consulting with tax professionals to ensure compliance and optimize their tax strategies. Understanding these implications is essential for managing the risks and obligations associated with cryptocurrency investments.

Disclaimer: This information material (regardless of whether it reflects opinions or not) is intended solely for general information purposes. It does not constitute independent financial analysis and is not financial or investment advice. It should not be relied upon as a decisive basis for an investment decision. This information material is never to be understood as GlazHome/CostGame recommending or deeming the acquisition or disposal of certain financial instruments, a particular timing for an investment decision, or a specific investment strategy suitable for any particular person. In particular, the information does not take into account the individual investment goals or financial circumstances of any individual investor. The information has not been prepared in accordance with the legal requirements designed to promote the independence of financial analysis and is therefore considered a marketing communication. Although GlazHome/CostGame is not expressly prevented from acting before providing the information, GlazHome/CostGame does not seek to gain an advantage by disseminating the information beforehand.

![You are currently viewing [Crypto Visualized] What is a Cryptocurrency Market](https://glazhome.com/wp-content/uploads/2024/06/TradNews.png)

Pingback: Introduction to Trading Terminology - Glaz Home