Forex, also known as FX, stands for Foreign Exchange. It involves the trading of currencies, where one currency is bought while another is simultaneously sold. This dual action means that currencies are always traded in pairs, commonly referred to as currency pairs.

The Forex trading market is the largest and most liquid financial market globally, often called the foreign exchange market or currency market. It operates 24 hours a day, five days a week, allowing traders to respond to currency fluctuations in real-time.

Forex trading is typically conducted through Contracts for Difference (CFDs) with leverage. This allows traders to gain greater exposure to the market with a smaller initial investment, potentially increasing both profits and risks.

In this comprehensive and free guide, you will learn the essentials of Forex trading, including how to use leverage effectively through CFDs. Whether you are a beginner or looking to refine your trading skills, this guide will provide valuable insights into navigating the dynamic world of Forex trading.

Table of Contents

How Does Forex Trading Work?

In Forex trading, individuals, companies, and organizations worldwide trade or exchange different currencies. In a currency pair, the first currency is called the base currency, and the second is the quote currency. As a trader, you speculate on the exchange rate movements: Will the value of one country’s currency rise or fall against another’s? We illustrate this principle with two trading examples:

Example A: You speculate that the EUR will rise against the USD in the EUR/USD currency pair. As a Forex trader, you go LONG.

Example B: You speculate that the EUR will lose points against the USD in the EUR/USD currency pair. As a Forex trader, you go SHORT.

With CMC Markets, you have the opportunity to trade Forex through CFDs (Contracts for Difference) with leverage. This means you only need to deposit a margin, a fraction of the total market value, to hold a position in the market. This allows you to control larger positions with a smaller initial investment.

Understanding Margin and Leverage in Forex Trading

Leverage plays a crucial role in Forex trading, especially for those with limited capital. Given the relatively minor fluctuations in currency exchange rates, often measured in pips to the fourth decimal place, leverage magnifies these small movements into significant financial opportunities. Forex brokers make these minimal rate changes impactful through leverage and tight spreads between buying and selling prices. Unlike traditional investments in international securities and goods where the value is retained in the local currency, Forex trading for private investors usually involves leverage, commonly through Contracts for Difference (CFDs). Leveraged trades enable traders to amplify potential returns, but they also come with increased risk. For example, with Forex margins starting at 3.3%, retail investors can achieve a leverage ratio of up to 1:30. This high leverage can lead to substantial profits, but it equally heightens the risk of significant losses. Therefore, novice traders are advised to start with a demo account to hone their trading skills before entering the real Forex CFD market. This approach ensures they are better prepared to manage the dual-edge nature of leverage, maximizing gains while mitigating risks.

Key Forex trading terms and their explanations:

| Term | Explanation |

|---|---|

| Forex (FX) | Foreign Exchange; the global market for trading currencies. |

| Currency Pair | Two currencies traded against each other in the Forex market, e.g., EUR/USD. |

| Base Currency | The first currency in a currency pair, which is bought or sold for the quote currency. |

| Quote Currency | The second currency in a currency pair, used to determine the value of the base currency. |

| Pip | The smallest price move in a currency pair, typically the fourth decimal place (0.0001). |

| Leverage | A tool that allows traders to control larger positions with a smaller amount of capital, amplifying both gains and losses. |

| Margin | The required deposit to open and maintain a leveraged position. |

| Spread | The difference between the bid (buy) price and the ask (sell) price of a currency pair. |

| Long Position | Buying a currency pair in anticipation that its value will increase. |

| Short Position | Selling a currency pair in anticipation that its value will decrease. |

| CFD (Contract for Difference) | A financial derivative allowing traders to speculate on price movements without owning the underlying asset. |

| Bid Price | The price at which the market is willing to buy a currency pair. |

| Ask Price | The price at which the market is willing to sell a currency pair. |

| Lot | A standard unit of measurement in Forex trading, typically 100,000 units of the base currency. |

| Hedging | A strategy used to offset potential losses in one position by taking an opposite position in another. |

| Liquidity | The ease with which an asset can be bought or sold in the market without affecting its price. |

| Stop-Loss Order | An order placed to sell a security when it reaches a certain price, used to limit potential losses. |

| Take-Profit Order | An order placed to sell a security when it reaches a certain profit level, used to lock in gains. |

Understanding Currency Abbreviations in Forex Trading

In Forex trading, currency abbreviations are essential for identifying different currencies. Each currency abbreviation typically consists of three letters: the first two letters represent the country or currency union, and the third letter represents the currency itself. For example, USD stands for the United States Dollar, EUR for the Euro, and JPY for the Japanese Yen. These abbreviations help traders easily recognize and trade various currency pairs in the Forex market. Below, you’ll find a list of the most commonly traded major and minor currencies along with their abbreviations.

| Currency | Abbreviation |

|---|---|

| United States Dollar | USD |

| Euro | EUR |

| Great British Pound | GBP |

| Japanese Yen | JPY |

| Swiss Franc | CHF |

| Australian Dollar | AUD |

| Canadian Dollar | CAD |

| New Zealand Dollar | NZD |

Understanding these abbreviations is crucial for trading in the Forex market, as it allows traders to quickly identify and work with different currencies.

Significant Growth in Forex Trading Volume: Trends and Indicators

Forex trading volume has seen significant changes over time, reflecting the growth and increasing complexity of global financial markets. Here are some key trends and data points about Forex trading volume:

- Growth in Daily Trading Volume:

- In 2019, the daily trading volume of the Forex market was approximately $6.6 trillion according to the Triennial Central Bank Survey by the Bank for International Settlements (BIS). By 2022, this figure had risen to about $7.5 trillion per day.

- Factors Influencing Volume:

- The highest volumes are typically seen in major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, due to their high liquidity. Trading volumes peak when the trading sessions of major financial centers overlap, such as the London and New York sessions.

- Economic data releases, geopolitical events, and central bank policy decisions also cause significant spikes in trading volumes as traders react to new information.

- Volume as an Indicator:

- Volume in Forex trading is used to gauge market activity and liquidity. High volume typically indicates strong market interest and the potential for significant price movements. Conversely, low volume can lead to less liquidity and higher volatility, particularly in minor or exotic currency pairs.

- Traders use volume indicators like tick volume, money flow index (MFI), and on-balance volume (OBV) to analyze market trends and potential reversals. For instance, increasing volume during a price movement can confirm the strength of a trend, while a lack of volume might suggest a potential reversal.

Understanding Forex Trading Hours

24/5 Trading Availability:

- Forex trading at CMC Markets can be conducted daily, around the clock, from Monday to Friday. This 24/5 trading schedule allows traders to engage in currency trading almost continuously during the week, accommodating different time zones and international markets.

Importance of Market Hours and Time Zones:

- While Forex markets are open 24 hours a day during the week, it’s important to consider the trading hours and time zones of specific markets to identify peak trading times. Recognizing these international peak times can help traders make more informed decisions.

Holiday and Weekend Breaks:

- Despite the extensive trading hours, Forex markets are typically closed on holidays and weekends. Traders are advised to plan for these breaks and use them for rest and recuperation.

Forex Trading Hours:

- Unlike stock markets with fixed trading hours, Forex trading doesn’t have a centralized exchange dictating trading times. Forex trading can theoretically occur 24 hours a day, depending on the currency pair, bank, and broker. During winter, the main Forex trading window is from Sunday 22:00 to Friday 23:00, shifting by an hour during the summer months. These trading hours align with the operating hours of brokers and banks facilitating currency exchanges.

How Are Forex Rates Determined?

The determination of Forex rates, also known as FX rates or exchange rates, is highly complex. Several key factors influence the development and fluctuations of these rates:

- Supply and Demand in the Forex Market: The balance between buyers and sellers of a currency significantly affects its value.

- Economic Conditions: The overall economic health of a country, including its GDP, employment rates, and industrial production, plays a crucial role.

- Inflation and Deflation: Changes in the price levels and purchasing power within a country influence its currency value.

- Central Bank Policies: Actions and policies of central banks, such as interest rate changes and monetary policy decisions, have a direct impact on currency values.

- Political and Economic Events: Political stability, economic policies, and significant events like elections or trade agreements can cause fluctuations in exchange rates.

In addition to these five central factors, numerous other circumstances can affect exchange rates. It’s important to stay informed about relevant events using tools like real-time economic calendars and push notifications from financial news services.

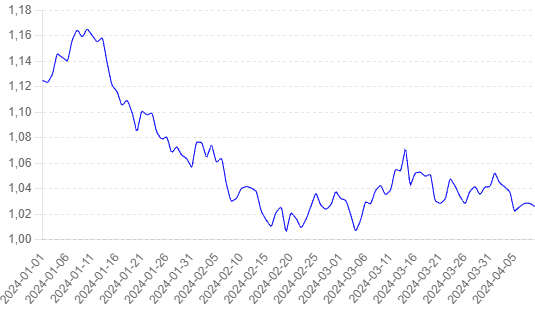

An Example for a Successful Forex Trade: The Case of EUR/USD Pair

The Setup: Alex, an experienced forex trader, noticed a potential trading opportunity with the EUR/USD pair. Here’s how Alex approached the trade:

Step 1: Research and Analysis Alex started by performing a detailed analysis of the EUR/USD pair:

- Fundamental Analysis: Alex reviewed economic indicators, such as interest rates, employment data, and GDP growth for both the Eurozone and the United States. The analysis showed a strengthening Euro due to positive economic data from the Eurozone and relatively weaker data from the US.

- Technical Analysis: Alex analyzed the EUR/USD chart and identified a bullish trend. The pair had recently bounced off a significant support level and was forming a bullish flag pattern, indicating a potential upward breakout.

- Market Sentiment: Alex monitored market sentiment through news and financial reports, observing a positive outlook for the Euro.

Step 2: Setting Up the Trade Based on the analysis, Alex decided to enter the trade:

- Entry Point: Alex chose to buy the EUR/USD pair at 1.1200, just as the pair broke out of the bullish flag pattern.

- Position Size: Alex allocated $10,000 to this trade with a leverage of 10:1, controlling a position size of $100,000.

- Stop Loss: To manage risk, Alex set a stop-loss order at 1.1150, limiting potential loss to 50 pips or $500.

- Take Profit: Alex set a take-profit order at 1.1300, aiming for a 100-pip gain or $1,000.

Step 3: Monitoring the Trade After entering the trade, Alex kept a close eye on the EUR/USD pair:

- Price Movement: The pair moved steadily upwards, validating the bullish outlook.

- Economic Data: Alex continued to monitor economic releases and news that could impact the trade.

Step 4: Exiting the Trade Alex planned the exit strategy carefully:

- Target Reached: A few days later, the EUR/USD pair reached the target price of 1.1300.

- Exit Point: Alex’s take-profit order was triggered, closing the trade at 1.1300.

The Outcome: The successful trade resulted in a substantial profit for Alex:

- Entry Price: 1.1200

- Exit Price: 1.1300

- Pips Gained: 100 pips

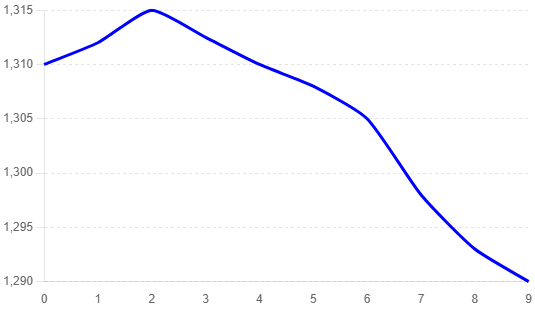

An Example for a Failed Forex Trade: The Case of GBP/USD Pair

The Setup: Mark, a relatively new forex trader, spotted what he believed was a trading opportunity with the GBP/USD pair. Here’s how Mark approached the trade:

Step 1: Inadequate Research and Analysis Mark’s preparation was insufficient and flawed:

- Fundamental Analysis: Mark did not thoroughly review the economic indicators or news impacting the British Pound or the US Dollar. He based his decision on a single news headline suggesting that the GBP might strengthen.

- Technical Analysis: Mark observed a short-term upward movement in the GBP/USD chart but failed to identify that it was within a broader downtrend. He ignored key resistance levels that could have indicated potential reversals.

- Market Sentiment: Mark did not check the overall market sentiment or other traders’ perspectives, relying solely on his limited interpretation.

Step 2: Setting Up the Trade Without proper analysis, Mark hastily entered the trade:

- Entry Point: Mark decided to buy the GBP/USD pair at 1.3100, assuming the upward movement would continue.

- Position Size: Mark allocated $5,000 to this trade with a leverage of 20:1, controlling a position size of $100,000.

- Stop Loss: Overconfident in his position, Mark set a wide stop-loss order at 1.2900, risking 200 pips or $2,000.

- Take Profit: Mark set an optimistic take-profit order at 1.3300, aiming for a 200-pip gain or $2,000.

Step 3: Ignoring the Trade After entering the trade, Mark did not monitor the GBP/USD pair effectively:

- Price Movement: The pair initially moved slightly upwards but then reversed direction as broader market trends took over.

- Economic Data: Mark ignored critical economic data releases and news that could impact the GBP/USD pair.

Step 4: Realizing the Mistake By the time Mark checked back on his trade, it was too late:

- Stop Loss Hit: The GBP/USD pair fell to 1.2900, triggering Mark’s stop-loss order and closing the trade at a significant loss.

The Outcome: The poorly executed trade resulted in a substantial loss for Mark:

- Entry Price: 1.3100

- Exit Price: 1.2900

- Pips Lost: 200 pips

- Loss: $2,000 (excluding trading costs and spreads)

Disclaimer: This information material (regardless of whether it reflects opinions or not) is intended solely for general information purposes. It does not constitute independent financial analysis and is not financial or investment advice. It should not be relied upon as a decisive basis for an investment decision. This information material is never to be understood as GlazHome/CostGame recommending or deeming the acquisition or disposal of certain financial instruments, a particular timing for an investment decision, or a specific investment strategy suitable for any particular person. In particular, the information does not take into account the individual investment goals or financial circumstances of any individual investor. The information has not been prepared in accordance with the legal requirements designed to promote the independence of financial analysis and is therefore considered a marketing communication. Although GlazHome/CostGame is not expressly prevented from acting before providing the information, GlazHome/CostGame does not seek to gain an advantage by disseminating the information beforehand.

Pingback: Introduction to Trading Terminology - Glaz Home

Pingback: "AI Trading Analysis Highlights Tech Surge & Oil Slump: Market Insights for 2024-10-09" - Glaz Home