A commodity market is a physical or virtual marketplace for buying, selling, and trading raw or primary products. These markets facilitate the exchange of commodities which are essential goods or raw materials. Commodities are typically divided into two broad categories: hard commodities and soft commodities. Hard commodities include natural resources that must be mined or extracted, such as gold, rubber, and oil, while soft commodities are agricultural products or livestock, such as corn, wheat, coffee, sugar, soybeans, and pork.

Table of Contents

The Ripple Effects of Commodity Price Fluctuations

Commodity price fluctuations, particularly in gold and oil, are often driven by geopolitical tensions and other factors, leading to significant economic impacts. When the prices of these commodities rise, the cost of fuel and heating increases, directly affecting both consumers and industrial companies. This escalation in costs trickles down to daily expenses, making fuel, heating, and food items such as bread and butter more expensive for consumers. However, these price variations also create investment opportunities. Savvy investors who understand commodity market dynamics can capitalize on these fluctuations by trading commodities like oil, gold, and wheat. The broader economy, especially energy-intensive industries, is highly sensitive to these price shifts. Increased energy costs can lead to financial strain on these industries, illustrating the far-reaching influence of commodity prices on economic health.

Commodities Overview

| Category | Main Commodities | Influence factors |

|---|---|---|

| Energy | Crude Oil (WTI, Brent), Natural Gas, Heating Oil, Gasoline | Supply and Demand Dynamics, Inventory Reports, Weather Conditions, Technological Advances |

| Metals | Gold, Silver, Copper, Platinum, Palladium | Economic Indicators, Industrial Demand, Safe-Haven Assets, Mining Supply |

| Agricultural | Corn, Wheat, Soybeans, Coffee, Sugar, Cotton | Weather Patterns, Global Demand, Government Policies, Crop Reports |

| Livestock | Live Cattle, Feeder Cattle, Lean | Feed Costs, Disease Outbreaks, Consumer Demand, Production Cycles |

Potential of Diverse Commodity Investments: From Gold to Coffee and Beyond

Modern financial advancements have opened the door for private investors to diversify their portfolios with a vast array of commodities. Energy commodities, especially crude oil, are heavily traded due to their volatile price fluctuations. Precious metals like gold and silver, along with platinum and palladium, remain popular choices for their investment potential. Industrial metals such as aluminum, copper, nickel, and zinc attract significant investor interest due to their crucial role in the economy.

Agricultural commodities, known as soft commodities, include grains like wheat and sugar, as well as cotton, coffee, cocoa, corn, and orange juice. Notably, coffee ranks as the second most traded commodity after oil. Among these, gold stands out as the most discussed precious metal, particularly for its potential price increases, while industrial metals are closely watched for their economic impact.

Although agricultural commodities receive less attention from private investors, their market importance is undeniable, with coffee being a major player. For those seeking sustainable investment options, renewable commodities like agricultural products, wood, and plant oils are preferred, offering a green alternative to fossil fuels and nuclear resources like uranium.

Diverse Investment Opportunities in Traded Commodities

A wide range of traded commodities is available in markets today, allowing private investors to include almost any commodity in their investment portfolios. Major commodity categories include energy commodities, such as crude oil, which experiences significant price fluctuations. Precious metals like gold, silver, platinum, and palladium are crucial assets traded in markets. Industrial metals, including aluminum, lead, copper, nickel, zinc, and tin, also play a vital role. Agricultural commodities (soft commodities) encompass important items such as wheat, sugar, cotton, coffee, cocoa, corn, and orange juice, with coffee being the second most traded commodity globally after oil. Among investor interests, gold is frequently discussed for speculation on its price increase. Developments in various industrial metals are closely monitored due to their economic importance. Some investors opt for sustainable investment options by focusing on renewable commodities like agricultural products, wood, and plant oils, while avoiding investments in fossil fuels and nuclear resources like uranium, aiming for more sustainable investments.

Trading Commodities – These Are Your Options

Standardized Futures Trading

Futures Trading at commodity futures exchanges like the Chicago Mercantile Exchange, involves trading commodities for future delivery dates. A Variety of Commodities is traded, including not only agricultural commodities and crops but also livestock such as pigs and live cattle. The Standardization of Contracts at these exchanges is characterized by specified delivery quantity, delivery date, and quality of the commodities. The place of fulfillment or trading, such as a loading port, is also precisely defined. These contracts involve Physical Delivery of the commodities, making them unsuitable for private investors.

Long-term Commodity Investments with Sector Funds, ETFs, and ETCs

Long-term Investment Options: Investors who want to bet on long-term increases in commodity prices can choose sector funds, ETFs (Exchange-Traded Funds), or ETCs (Exchange-Traded Commodities). Exchange-Traded Commodities (ETCs): ETCs are a special type of certificate that are perpetual and secured debt securities, allowing investors to benefit from commodity market developments in a convenient and cost-effective manner. Cost and Convenience: ETCs offer a particularly comfortable and economical way for investors to participate in the developments of the oil market.

Investing in Commodities Through Top Mining Stocks

Investors can explore Indirect Investment in Commodities by purchasing commodity stocks of companies involved in production or trading, rather than directly investing in commodities. Notable companies in this sector include BHP Billiton Ltd., the largest mining company globally, operating in iron ore, oil/gas, copper, and coal; Rio Tinto Plc., the second-largest mining company and a blue-chip stock founded in 1873 with 50,000 employees worldwide; Anglo American Plc., another major British mining operator; and Mondi Plc., which covers the entire value chain from forestry to paper production, employing 25,000 people. For Investment Requirements, investors need a securities account (depot) with a bank or online broker. The article suggests using services like finanzen.net zero1 and recommends comparing depots to find the most suitable one.

CFD Trading on Commodities

CFD Trading: CFDs (Contracts for Difference) allow investors to participate in the price movements of commodities like oil, gold, or corn without owning the physical commodities. Leverage: Speculative investors use CFDs to leverage their investments. For example, a 1% increase in the oil price can result in a 30% gain with a leverage of 30. Direct 1:1 participation is also possible. Platforms: Platforms like Plus500 and eToro are mentioned as options for trading CFDs. Plus500 offers quick account opening and credit card payments, while eToro allows payments via PayPal and credit card and also features fast account setup. Broker Choice: Investors can choose any CFD broker they prefer.

Cost-Effective Commodity Investments with ETFs

Availability of ETFs: Investors have the option to invest in commodities through ETFs (Exchange-Traded Funds) as well as ETCs. Cost Efficiency: ETFs provide a particularly cost-effective way to invest in an index, generally having lower fees compared to actively managed funds. Passive Management: Unlike mutual funds, ETFs are not actively managed by a fund manager; they track their respective indices more or less passively.

Example of a Commodity ETF: The Lyxor STOXX Europe 600 Basic Resources UCITS ETF (WKN: LYX04D) is an example of a broad market ETF that tracks the performance of the European commodity sector through the STOXX® Europe 600 Basic Resources Price Index. This ETF is noted for its low total expense ratio of just 0.30%, is dividend-paying, and is denominated in Euros.

Diverse ETC Options by BNP Paribas

Types of ETCs Offered by BNP Paribas:

RICI® Enhanced Brent Oil (TR) ETC: This ETC allows investors to benefit from a rising Brent Crude Oil price without currency hedging, thus exposing them to both currency gains and losses. The annual management fee is 1.00%.

EUR Hedged RICI Enhanced Brent Crude Oil Index ETC: This ETC offers currency hedging, neutralizing exchange rate risks daily, which reduces unwanted currency fluctuations. The annual management fee is 1.20%, slightly higher than the non-hedged version but significantly cheaper than typical Quanto products.

Currency Risk and Cost Efficiency: The non-hedged ETC provides exposure to currency fluctuations, while the hedged version reduces currency risk at a slightly higher cost. The hedged ETC’s cost efficiency in currency neutralization is highlighted as it is cheaper than standard Quanto products.

Reinvestment of Interest Earnings: Both ETCs reinvest interest earnings from the investments, with the index level reflecting these reinvested returns (Total Return).

Industrial Metals ETC: The EUR Hedged RICI Enhanced Industrial Metals Index ETC tracks the RICI® EnhancedSM INDUSTRIAL METALS (TR) INDEX, reflecting investments in futures contracts for various industrial metals like copper, aluminum, zinc, lead, nickel, and tin, with different maturities. It is currency hedged with an annual management fee of 1.20%.

Diverse Commodity Funds for Long-Term Investment

Variety of Funds: There is a wide selection of commodity investment funds available for investors.

Top Performer Example: The Optinova Metals and Materials (WKN: A1J3K9) is highlighted as a top performer in recent years. It invests indirectly in commodity markets through commodity stocks and ETCs on metals and agricultural commodities.

Sector-Specific Investment: The Structured Solutions Lithium Index Strategy Fund (WKN: HAFX4F) is an interesting sector-specific bet on lithium. Lithium is critical for batteries in smartphones, laptops, digital cameras, and especially electric vehicle motors. However, the stock prices of related companies might already be high due to the ongoing interest in lithium investments.

Purchase Costs and Long-term Suitability: Investors usually face an upfront charge of up to five percent when buying investment funds, making them more suitable for long-term investments. Over 2,100 funds can be added to a portfolio without order fees (except for typical market spreads) using a depot at finanzen.net zero1, offering significant savings on purchases.

Commodity Investments with Certificates

Ease of Investment: Private investors can easily invest in commodities like silver, palladium, coffee beans, and many others through certificates. Trading Convenience: Certificates can be bought and sold through any securities account, similar to stocks, with banks providing buy and sell prices typically from 8 AM to 10 PM. Currency Risk Management: Quanto certificates allow investors to eliminate currency risk since commodities are usually priced in US dollars, which is relevant for Euro-zone investors. Risk of Issuer Default: Certificates are debt securities, meaning if the issuing bank goes bankrupt, the certificate becomes worthless, regardless of the underlying commodity’s value. This risk became prominent after the Lehman Brothers collapse in 2008. Speculation and Indices: Investors can speculate on rising and falling prices with leverage or discount certificates and invest in certificates linked to major sector indices, such as the RICI-Index by Jim Rogers.

Understanding Price Formation and Roll Effects in Leverage and Investment Products

Price Formation: For open-end leverage and investment products, issuers typically link price formation to the nearest expiring futures contract due to high trading liquidity, rolling the position to the next maturity shortly before the current one expires.

Term Structure Awareness: Investors using open-end participation certificates for long-term strategies should understand the underlying term curve to estimate the impact of roll effects. This can often be gauged by looking at the difference between the prices of the two nearest contracts.

Adjustment Mechanism: Issuers cannot charge or credit roll costs directly. Instead, they adjust the reference ratio for open-end participation certificates. Roll costs decrease the reference ratio, reducing the controlled amount of the underlying asset. Conversely, roll gains increase the reference ratio, increasing the controlled amount of the underlying asset.

Leverage Products: For open-end leverage products, the issuer adjusts the base prices instead of the reference ratio. Roll costs increase the base price of long leverage products (and decrease it for short products). Roll gains decrease the base price of long leverage products (and increase it for short products).

Fixed Maturity Products: Products with a fixed maturity, like options and knock-out products, reference a specific contract maturity (e.g., a December Brent Crude Oil future). The price of these products is determined solely by the specified contract price from the issue date. These products do not involve roll transactions but are less suitable for short-term price movements if the maturity date is distant.

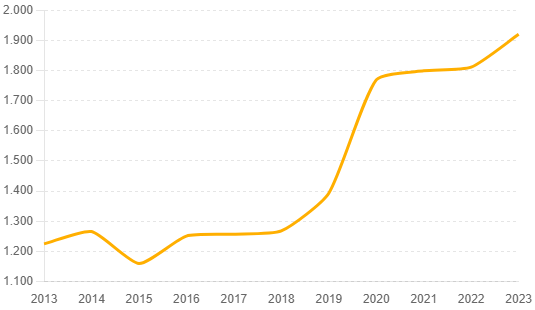

Example: How Investing in Gold Paid Off

Initial Investment and Strategy

In 2013, an investor decided to allocate $10,000 to gold, seeing it as a hedge against inflation and economic instability. The strategy was to hold the investment long-term, benefiting from the steady appreciation of gold prices.

Performance Over Time

To illustrate the performance, we’ll use two graphs: one showing the annual price of gold from 2013 to 2023, and another showing the cumulative return on investment (ROI).

Annual Gold Prices (2013-2023)

Cumulative ROI (2013-2023)

Factors Contributing to Success

a. Economic Uncertainty: Gold often performs well during periods of economic instability. The investment period included several such phases.

b. Inflation Hedge: As inflation fears grew, gold became an attractive asset, driving up its price.

c. Diversification: The investor’s portfolio was diversified, with gold providing a safety net against volatility in other markets.

After investing $10,000 in gold in 2013, the value of the investment would be $15,673 by 2023, given a cumulative ROI of 56.73%.

Disclaimer: This information material (regardless of whether it reflects opinions or not) is intended solely for general information purposes. It does not constitute independent financial analysis and is not financial or investment advice. It should not be relied upon as a decisive basis for an investment decision. This information material is never to be understood as GlazHome/CostGame recommending or deeming the acquisition or disposal of certain financial instruments, a particular timing for an investment decision, or a specific investment strategy suitable for any particular person. In particular, the information does not take into account the individual investment goals or financial circumstances of any individual investor. The information has not been prepared in accordance with the legal requirements designed to promote the independence of financial analysis and is therefore considered a marketing communication. Although GlazHome/CostGame is not expressly prevented from acting before providing the information, GlazHome/CostGame does not seek to gain an advantage by disseminating the information beforehand.

Pingback: Introduction to Trading Terminology - Glaz Home