Trading in financial markets involves a lot of jargon. Understanding these terms is essential for effective communication and making informed decisions. This guide will cover basic to advanced trading terms with explanations, examples, and visual aids.

Table of Contents

1. Basic Trading Terms

1.1. Market Types

- Definition: A public market where investors can buy and sell shares of publicly traded companies. Companies list their shares on stock exchanges through initial public offerings (IPOs) to raise capital.

- Example: The New York Stock Exchange (NYSE) and NASDAQ are prominent stock markets.

- How It Works: Investors purchase shares they believe will increase in value over time, earning returns through capital gains and dividends.

- Definition: The foreign exchange (Forex or FX) market is a global decentralized market for trading currencies. It is the largest and most liquid financial market in the world.

- Example: Trading pairs like EUR/USD (Euro/US Dollar), GBP/JPY (British Pound/Japanese Yen).

- How It Works: Participants buy one currency while simultaneously selling another. Forex trading occurs 24 hours a day, five days a week, across major financial centers worldwide.

- Definition: A market where traders buy and sell raw materials and primary products. Commodities are categorized into two types: hard commodities (natural resources like gold, oil, and minerals) and soft commodities (agricultural products like wheat, coffee, and sugar).

- Example: Chicago Mercantile Exchange (CME) and London Metal Exchange (LME).

- How It Works: Commodities can be traded directly or through derivatives such as futures and options contracts.

- Definition: A digital or virtual market for buying and selling cryptocurrencies. Cryptocurrencies are decentralized digital assets based on blockchain technology.

- Example: Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) are popular cryptocurrencies traded on exchanges like Coinbase and Binance.

- How It Works: Investors trade cryptocurrencies in exchanges, either for other cryptocurrencies or fiat currencies. Market participants can speculate on price movements or use cryptocurrencies for various transactions.

1.2. Order Types

Market Order:

- Definition: An order to buy or sell a security immediately at the current market price. It guarantees execution but not the price.

- Example: If you place a market order to buy 100 shares of Company X at $50, the order will be executed at the best available price, which might be slightly higher or lower due to market fluctuations.

- When to Use: Best used when the priority is speed of execution over price, typically in highly liquid markets.

Limit Order:

- Definition: An order to buy or sell a security at a specific price or better. It ensures price but not execution.

- Example: If you place a limit order to buy 100 shares of Company X at $48, the order will only execute if the share price drops to $48 or lower.

- When to Use: Ideal for investors who want to control the price at which they trade, useful in less liquid markets or volatile stocks.

Stop Order (Stop-Loss Order):

- Definition: An order to buy or sell a security once it reaches a specified price, known as the stop price. Designed to limit an investor’s loss on a position.

- Example: If you own shares of Company X at $50 and set a stop-loss order at $45, the order will execute as a market order if the price drops to $45 or below, selling your shares to prevent further losses.

- When to Use: Useful for managing risk and protecting against significant losses in volatile markets.

1.3. Basic Concepts

Bid Price:

- Definition: The highest price a buyer is willing to pay for a security at a given time.

- Example: If the bid price for Company X’s stock is $50, it means a buyer is willing to purchase shares at $50 each.

- Importance: Indicates the demand for a security and helps sellers understand what buyers are willing to pay.

Ask Price:

- Definition: The lowest price a seller is willing to accept for a security at a given time.

- Example: If the ask price for Company X’s stock is $51, it means a seller is willing to sell shares at $51 each.

- Importance: Indicates the supply of a security and helps buyers understand the seller’s price expectations.

Spread:

- Definition: The difference between the bid price and the ask price of a security.

- Example: If the bid price is $50 and the ask price is $51, the spread is $1.

- Importance: Represents the cost of trading and liquidity of the market. A smaller spread usually indicates a more liquid market.

Volume:

- Definition: The total number of shares or contracts traded in a security or market during a given period.

- Example: If 1,000,000 shares of Company X are traded in a day, the daily trading volume is 1,000,000.

- Importance: High volume indicates high interest and liquidity in a security, often leading to better price stability and easier execution of trades.

1.4 Value Investing vs. Growth Investing

Value Investing and Growth Investing are two primary strategies investors use in the stock market to achieve financial returns. Each approach has its own principles, methodologies, and risk profiles. Understanding these differences can help investors choose the strategy that aligns best with their financial goals and risk tolerance.

Value Investing:

- Objective: To find and invest in stocks that are undervalued by the market, with prices lower than their intrinsic value.

- Strategy: Focus on financial metrics and fundamentals to identify undervalued stocks. This approach involves holding these stocks long-term until the market recognizes their true value.

- Key Indicators: Price-to-Book (P/B) ratio, Price-to-Earnings (P/E) ratio, Debt-to-EBITDA ratio, EBITDA, and LTM averages.

- Prominent Figures: Benjamin Graham, David Dodd, Warren Buffett.

- Advantages: Lower risk, steady long-term returns, suitable for conservative, patient investors.

- Disadvantages: Stocks may remain undervalued for extended periods, requiring in-depth analysis and patience.

Growth Investing:

- Objective: To invest in companies with high potential for future growth, often characterized by rapidly increasing revenues and market expansion.

- Strategy: Focus on future potential and market expectations rather than current undervaluation. This involves investing in companies expected to grow significantly faster than the market average.

- Key Indicators: Revenue growth rate, user growth, sales dynamics, Price-to-Sales (P/S) ratio, and forward-looking multiples like PEG ratio.

- Prominent Figures: Modern examples include investors in companies like Tesla and Amazon during their high-growth phases.

- Advantages: Potential for high returns, especially in bull markets or when investing early in a company’s growth phase.

- Disadvantages: Higher risk due to reliance on future growth projections, which may not materialize. Stocks can be highly volatile and subject to market hype.

2. Advanced Trading Terms

2.1. Chart Types

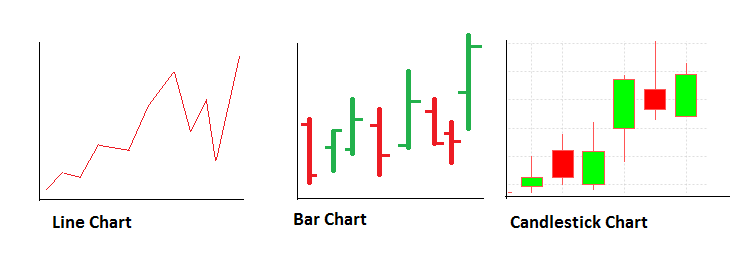

Line Chart:

- Definition: A type of chart that displays information as a series of data points called ‘markers’ connected by straight line segments. It is typically used to visualize a trend in data over intervals of time.

- Example: A line chart of a stock’s closing prices over the past year shows how the price has moved over time.

- Importance: Simple and easy to understand, ideal for showing overall trends and long-term movements.

Bar Chart:

- Definition: A chart that represents data with rectangular bars with lengths proportional to the values they represent. In trading, it displays the open, high, low, and close prices for a specific period.

- Example: Each bar represents one day, with the top of the bar indicating the highest price and the bottom the lowest price. The left tick shows the opening price, and the right tick shows the closing price.

- Importance: Provides a more detailed view of price movements within a specific time frame compared to a line chart.

Candlestick Chart:

- Definition: A chart that uses candlestick shapes to display the open, high, low, and close prices for a specific period. Each candlestick represents one period of data (e.g., one day).

- Example: A candlestick with a long body indicates strong buying or selling pressure, while a candlestick with a short body suggests little price movement.

- Importance: Offers a clear visual representation of market sentiment and price action, widely used by traders to identify patterns and trends.

2.2. Indicators

Moving Average (MA):

- Definition: A calculation that helps smooth out price data to create a single flowing line, making it easier to identify the direction of the trend. It averages the price data over a specified number of periods.

- Types:

- Simple Moving Average (SMA): The average price over a specific number of periods.

- Exponential Moving Average (EMA): A weighted average that gives more importance to recent prices.

- Example: A 50-day SMA is calculated by summing the closing prices of the last 50 days and dividing by 50.

- Importance: Helps identify the direction of the trend and potential support and resistance levels.

Relative Strength Index (RSI):

- Definition: A momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100.

- Example: RSI values above 70 indicate that a security is overbought, while values below 30 indicate that it is oversold.

- Importance: Helps identify overbought or oversold conditions in a market, signaling potential reversals or continuation of trends.

Bollinger Bands:

- Definition: A volatility indicator that consists of a middle band (usually a 20-day SMA) and two outer bands (standard deviations above and below the middle band).

- Example: When the price moves closer to the upper band, the asset is considered overbought; when it moves closer to the lower band, it is considered oversold.

- Importance: Indicates market volatility and potential overbought or oversold conditions, helping traders make buy or sell decisions.

2.3. Trading Strategies

Scalping:

- Definition: A trading strategy that involves making numerous small profits on small price changes throughout the day. Scalpers hold positions for a very short time.

- Example: A trader buys a stock at $50.00 and sells it at $50.05 multiple times a day, aiming to accumulate small gains.

- Importance: Requires a high level of concentration and quick decision-making, suitable for highly liquid markets.

Day Trading:

- Definition: Buying and selling financial instruments within the same trading day, with positions closed before the market closes.

- Example: A day trader buys shares of Company X in the morning and sells them in the afternoon based on intraday price movements.

- Importance: Avoids overnight risks, relies on short-term market movements, and requires constant market monitoring.

Swing Trading:

- Definition: A strategy where traders hold positions for several days to weeks to capitalize on expected market movements.

- Example: A swing trader buys a stock at $50, expecting it to reach $55 in the next week based on technical analysis.

- Importance: Takes advantage of short- to medium-term price trends, requiring less time commitment compared to day trading.

Position Trading:

- Definition: A long-term strategy where traders hold positions for months to years, based on fundamental analysis.

- Example: An investor buys shares of a promising tech company and holds them for several years, expecting significant growth.

- Importance: Focuses on long-term gains, involves less frequent trading and lower transaction costs.

2.4. Risk Management

Diversification:

- Definition: The practice of spreading investments across various assets to reduce exposure to any single asset or risk.

- Example: An investor holds a portfolio consisting of stocks, bonds, commodities, and real estate.

- Importance: Reduces the impact of a poor-performing asset on the overall portfolio, helping to manage risk.

Hedging:

- Definition: Using financial instruments or market strategies to offset potential losses in investments.

- Example: An investor holding stocks buys put options to protect against a potential drop in stock prices.

- Importance: Mitigates potential losses and protects investments from adverse market movements.

Leverage:

- Definition: Using borrowed capital to increase the potential return of an investment. While it amplifies gains, it also increases potential losses.

- Example: A trader uses a 2:1 leverage to invest $20,000 with only $10,000 of their own money, borrowing the remaining $10,000.

- Importance: Can enhance returns, but increases risk and requires careful management to avoid significant losses.

Disclaimer: This information material (regardless of whether it reflects opinions or not) is intended solely for general information purposes. It does not constitute independent financial analysis and is not financial or investment advice. It should not be relied upon as a decisive basis for an investment decision. This information material is never to be understood as GlazHome/CostGame recommending or deeming the acquisition or disposal of certain financial instruments, a particular timing for an investment decision, or a specific investment strategy suitable for any particular person. In particular, the information does not take into account the individual investment goals or financial circumstances of any individual investor. The information has not been prepared in accordance with the legal requirements designed to promote the independence of financial analysis and is therefore considered a marketing communication. Although GlazHome/CostGame is not expressly prevented from acting before providing the information, GlazHome/CostGame does not seek to gain an advantage by disseminating the information beforehand.

Pingback: Qu'est-ce que le trading d'actions ? - Glaz Home